Streamline Clearing and Exchange Management

Pacsquare specializes in offering customized clearing solutions for exchange-traded futures and options contracts in the derivatives markets. Our Clearing solution involves several key functions, including risk management, margin calculations, and ensuring the efficient and smooth completion of transactions. While our Exchange-traded derivatives, like futures and options contracts, are standardized contracts that derive their value from an underlying asset, such as commodities, stock indices, or interest rates.

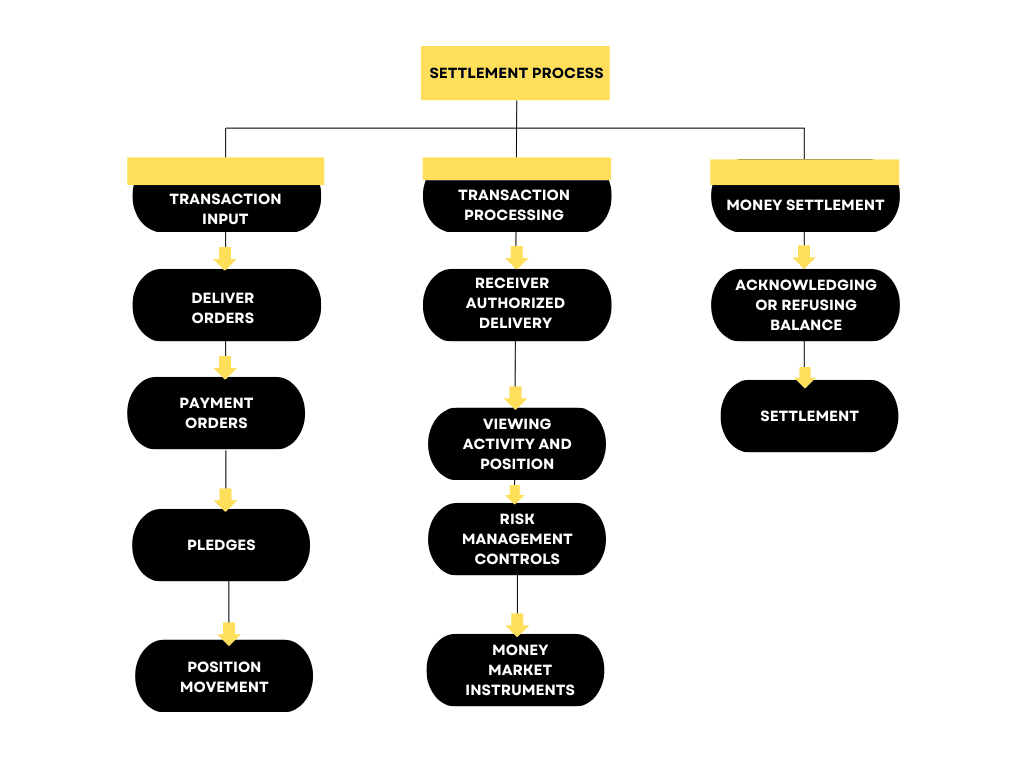

Explore our solutionsSettlement Process

Margin Calculations

To mitigate counterparty risk, Pac Exchanges and Clearing Solutions establish margin requirements. The amount of margin is determined based on factors such as the volatility of the underlying asset and the size of the position. By setting appropriate margin levels, the clearing house creates a financial cushion to absorb potential losses.

Modernizing Post-Trade Platform

Pacsquare's commitment to modernizing its post-trade platform represents a strategic vision to transform the financial industry. At the core of this initiative is a dedication to embracing cutting-edge technologies, refining data management practices, and upholding the highest standards of security and compliance.